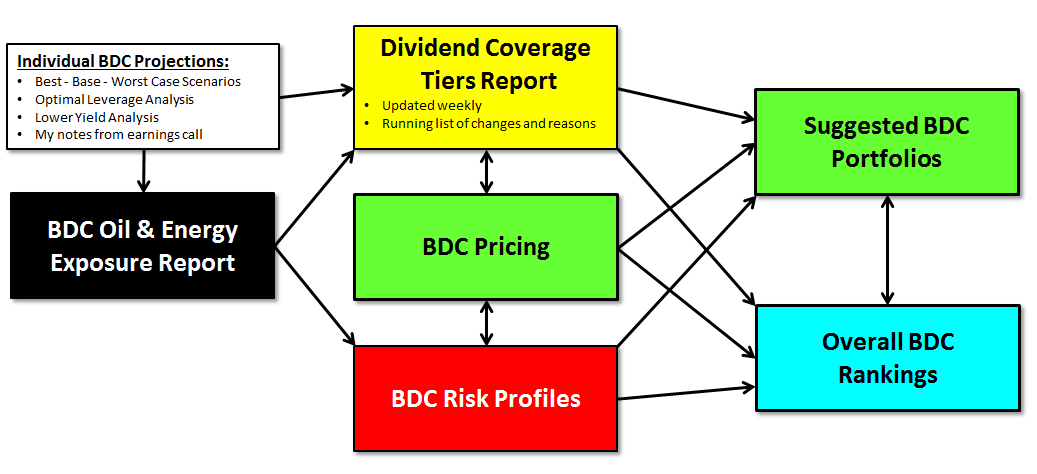

My goal is to prioritize the best potential performers as well as underpriced/overlooked BDCs that are offering higher yields. I will be adding some of these BDCs to the updated Suggested BDC Portfolios report as well as removing BDCs that have been downgraded to ‘Tier 3’ dividend coverage and likely to cut dividends later this year. I will have public articles for some of these companies to increase exposure/awareness and hopefully trading volumes and pricing, but they will mostly discuss basic information such as historical dividend coverage, change in NAV per share and high-level asset mix. See below for examples.

Currently, I am researching the following items for each company before adding to coverage:

- Risk (portfolio credit quality and vintage, quality of management, historical credit and NAV performance, effective leverage ratios, portfolio diversification, rate sensitivity, and the need to reach for yield to sustain dividends)

- Profit (historical and projected dividend coverage, yield compression sustainability, repayment exposure, recurring vs. onetime income, PIK vs. cash, EPS growth/decline, operational cost efficiency)

- Return (regular/special dividends, risk adjusted, dividend sustainability/growth, NAV stability/growth)

- Valuation (total return, appropriate yields, NAV and earnings multiples, growth rates)

High Water Mark Fee Structures:

As discussed in many of my articles, The older incentive fee structures can incentivize management to take on increased risk with investors' capital. Management benefits from higher yields with less downside related to future credit issues or the lack of capital losses included when calculating income incentive fees. This could lead to management taking higher risks (for increased yields) with investors’ capital due to being insulated from potential losses when calculating the income portion of the incentive fees. Ultimately, management could receive higher fees during periods of declining NAV per share, resulting in lower total returns to shareholders.