FYI – I have

decided to make this newsletter a monthly

publication that will include more detail in the following months.

Included in this report:

- BDC Market Update

- Example: FSC Dividend & Fee Income Analysis

- BDC Earnings Announcements & MCC: Items to Watch

BDC Market Update

As

discussed in many recent articles, 2014 was a tough year for BDCs due to them

being removed from the S&P and Russell indices, continued interest rate

fears, general declines in small caps, selling institutional shareholders over

the last two quarters and December tax-loss sellers. More recently, investors

have been concerned with oil and energy exposure among portfolio investments.

BDCs have started to rebound and are up an average of 5% since mid-December.

FSC Dividend

& Fee Income Analysis

The following analysis is for dividend

and fee income comparison only – these are not

my projections.

After

each company reports results I use a similar analysis to assess dividend

coverage going forward. Key items to watch are stated and effective portfolio

yields, fee and dividend income potential and operation cost efficiencies.

Other important items are related to portfolio credit quality. Many BDCs are reliant on non-interest income

to cover dividends that can cause swing in quarterly EPS/NII and dividend

coverage. The following is an example

using Fifth Street Finance (FSC)

that recently increased its dividend and relies on dividend and fee income to support 20% of its dividend payment.

The

following are the analyst estimates for the next two quarters.

Earnings Announcements:

Items to Watch

So

far only six BDCs that I follow have reported results including AINV, GLAD,

GBDC, PFLT, PNNT and PSEC. This week FSC, MCC and FULL will be reporting and

investors should pay close attention to dividend coverage potential and portfolio

credit quality indicators, especially for MCC.

As discussed in “Medley

Capital Update For FQ4 2014”, the company recently reported a large decline

in its portfolio yield and was only able to cover dividends due to strong fee

income. This could be a problem going forward depending on a few things

including increased non-accruals and lower amounts of non-interest related

income such as fees and dividends. Please see the FSC example below.

I

have already weighed in on the Prospect Capital (PSEC) dividend coverage

potential in my “PSEC: Dividend Coverage Stress Test” and if you

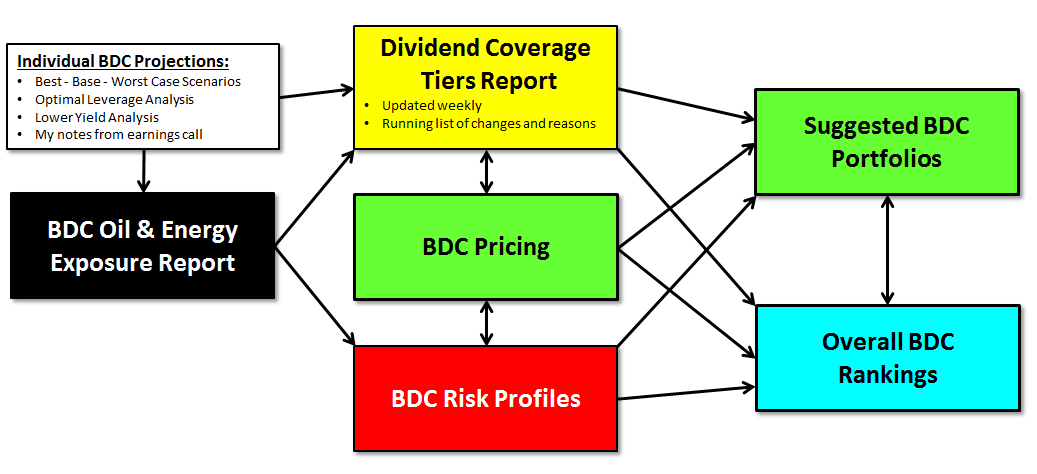

would like to receive similar analyses for the remaining BDCs please visit “Premium Reports”. For most

companies I try to turnaround the new information before markets open the next

day with my personal recommendations. Currently there are around 40 reports

including dividend coverage, oil and energy exposure, interest rate

sensitivity, my current positions and allocations, overall rankings and

pricing, suggested portfolios, etc.

- $65 for all reports through 6/30/15

- $95 for all reports through 9/30/15

- $145 for all reports through 12/31/15

- Link to report details: Sign Up

No comments:

Post a Comment