BDC Market Update

This

year has been difficult for BDCs due to being removed from the S&P and

Russell indices, continued interest rate fears, general declines in small caps,

selling institutional shareholders over the last two quarters and December

tax-loss sellers. I believe that some

investors have been selling baskets of investments, including higher quality BDCs,

which has created an opportunity for investors. At some point, BDCs will

rebound and I will have a series of articles coming out that discusses many of

the positive signs that we are seeing including lower borrowing costs,

stabilizing or even increasing portfolio yields and less competition from banks

as they continue to exit level 3 assets.

Over

the next two to three weeks, BDCs will either continue to fall, have a ‘dead

cat bounce’ or potentially have a sustained rally into 2015. Investors should

be ready for all three of these

scenarios and to buy preferred BDCs over the coming weeks. As shown in the

previous chart, I believe investors are currently reacting out of fear (in both

the general and BDC markets). The

following chart shows the VIX hitting a high in mid-October at the same time

BDCs hit a low for the year and there are signs that the VIX is headed to these

levels yet again. Volatility – or “market whiplash” – is clearly back

in the market.

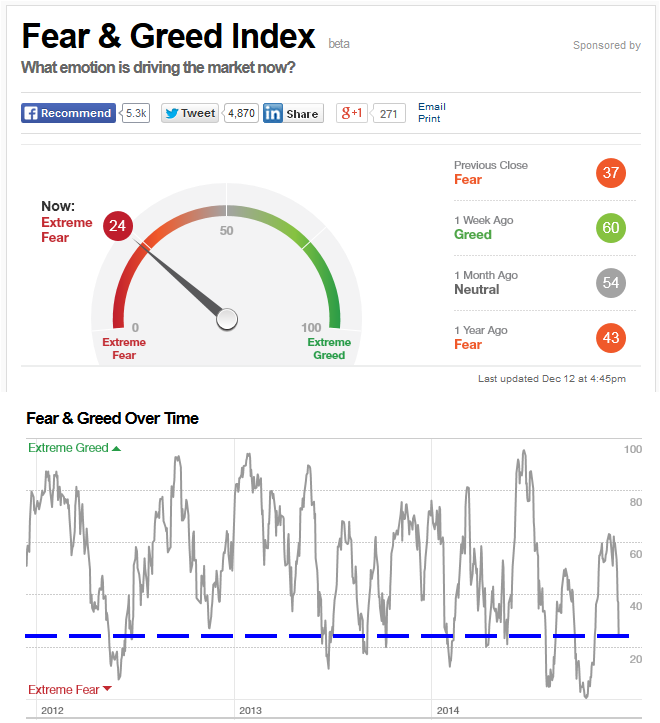

The CNN Money Fear & Greed Index:

Investors

are driven by two emotions: fear and greed. Too much fear can sink stocks well

below where they should be. When investors get greedy, they can bid up stock

prices way too far.

“We

look at 7 indicators: For each

indicator, we look at how far they've veered from their average relative to how

far they normally veer. We look at each on a scale from 0 - 100. The higher the

reading, the greedier investors are being, and 50 is neutral.”

Source:

CNN

Money

What should

investors do over the next few weeks?

Investors

should be ready to buy BDCs that fit their investment profile. Recently I have noticed that pricing

multiples have changed to reflect investors’ perceptions of dividend coverage

and risk or capital preservation. BDCs

that continue to trade at lower NAV per share multiples will be capital

constrained and could risk losing various credit ratings that could contribute

to a higher cost of capital.

There

will likely be continued basket and tax-loss selling but at some point I

believe BDCs will rebound sharply as

they did after the October 15th lows. Also I believe investors will

continue to pay higher multiples for higher quality BDCs giving them a clear

advantage going into 2015.

Premium Reports:

- $60 for all reports through 3/31/15.

- $95 for all reports through 6/30/15.

- $165 for all reports through 12/31/15.

No comments:

Post a Comment